Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ever tried logging into your Kia Finance account and felt lost? You’re…

Quantitative finance interviews are notorious for being tough, technical, and often unpredictable.…

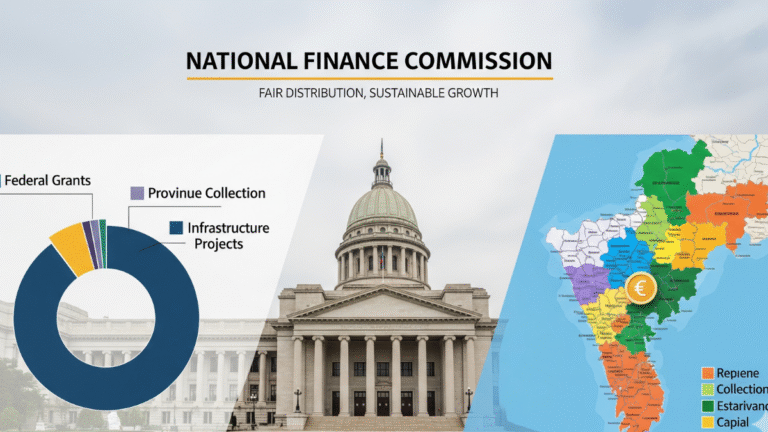

Have you ever wondered how government resources are distributed across provinces and…

Replacing or upgrading an HVAC system can feel overwhelming, especially when you…

Ever stared at your monthly car payment and thought, “Is it even…

“Did you know the average federal student loan borrower owes over $37,000…

“Did you know that in the U.S. alone, student loan debt has…

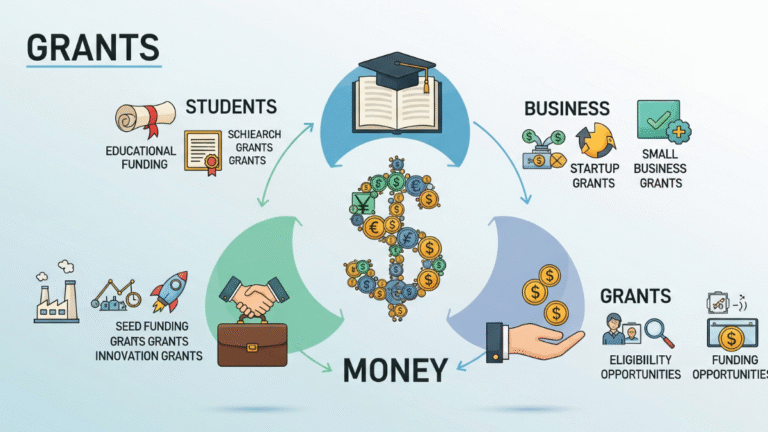

Ever heard someone call grants “free money” and thought, what’s the catch?…

“How long does it take to get a student loan?” is one…

Did you know that specially designated investment zones have fueled billions of…