Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

“Do you need a financial representative or a financial advisor? Believe it or not, most people don’t know the difference!” According to a recent survey, nearly 60% of Americans say they’re unsure who to turn to when seeking professional financial help. That’s not surprising, titles in the finance world often sound similar, but the roles can be very different.

In this article, we’ll clear up the confusion between a financial representative vs. financial advisor, explain what each does, highlight their differences, and help you decide which one is best suited for your needs. By the end, you’ll know exactly who to call for retirement planning, investments, or even just understanding your insurance options.

I remember the first time I sat down with a financial representative. I thought I was meeting someone who would map out my entire financial future. Instead, what I got was a breakdown of a few insurance products and a gentle nudge toward opening an account. That’s when it clicked, financial representatives aren’t the same as financial advisors, and their role is actually a lot narrower.

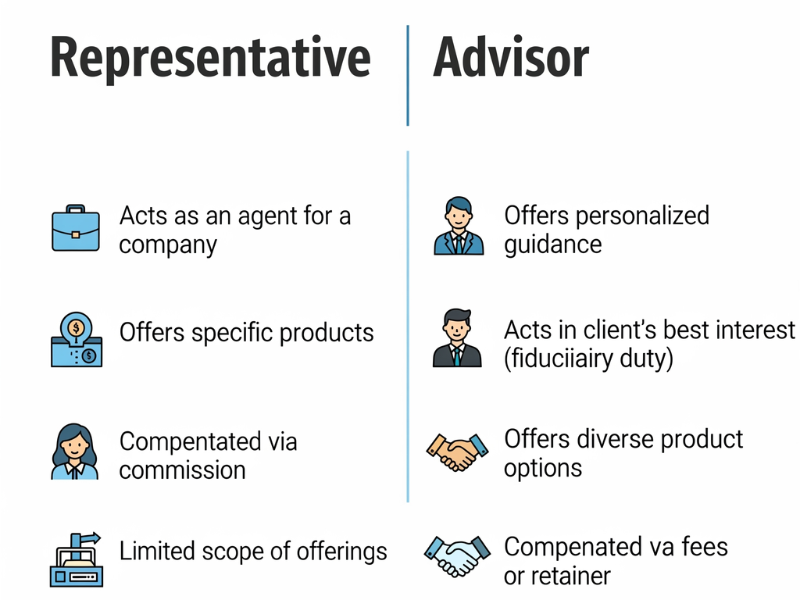

A financial representative is usually someone who sells financial products on behalf of a company. Think insurance policies, annuities, or mutual funds. They’re licensed to represent that company’s offerings, which means their main job is to connect you with products that might fit your needs. But here’s the catch, they often work more like sales reps than independent planners.

Most financial representatives spend their time meeting clients, explaining products, and handling paperwork. If you’ve ever had someone walk you through the details of a life insurance policy, there’s a good chance they were a financial representative. They can help you open investment accounts, purchase insurance, or enroll in retirement products tied to their company. What they don’t usually do is provide holistic financial planning.

A financial representative doesn’t need the long list of certifications that financial advisors do. In most cases, they’re required to hold licenses like Series 6 or Series 7, plus state insurance licenses if they’re selling insurance. While these credentials allow them to sell products legally, they don’t mean the rep is trained to give you comprehensive planning advice. That’s something I wish I had known earlier, I assumed “licensed” meant “qualified to handle everything.”

You’ll run into financial representatives in all sorts of places. Insurance companies hire them to sell policies, banks employ them to connect clients with savings and investment accounts, and large investment firms rely on them for mutual funds and annuities. Basically, anywhere financial products are sold, you’ll find financial representatives doing the talking.

Here’s the most important thing: financial representatives are usually tied to the company they work for. That means their recommendations can be limited to that company’s products. For example, if you meet with an insurance rep, they’ll only show you policies from their employer, even if there’s a better deal across the street. That doesn’t make them “bad”, but it does mean their advice may not always be the most objective.

When I realized this, I started asking different questions. Instead of, “What do you recommend?” I’d ask, “Are you only showing me your company’s products?” It’s a small shift, but it can save you from thinking you’re getting personalized planning when you’re really just being shown a menu of in-house options.

The first time I worked with a financial advisor, I could tell right away this was a different ballgame compared to a financial representative. Instead of pulling out brochures for one company’s products, the advisor asked me about my goals, retirement, debt, and even what kind of lifestyle I wanted later in life. That’s when I realized financial advisors don’t just sell products; they build strategies.

A financial advisor is someone who helps you create a personalized plan for your money. Unlike a financial representative, who’s usually tied to one company, an advisor looks at your entire financial picture. They consider your income, investments, debts, retirement goals, and even your family situation. Their main role is to guide, not just sell.

Financial advisors wear a lot of hats. They can help you design a retirement plan so you don’t outlive your savings, manage your investments so your money grows, and even set up an estate plan so your family is taken care of after you’re gone. I remember my advisor drawing up a chart that showed me how a few extra contributions to my 401(k) could save me thousands in taxes down the line. That’s the kind of hands-on advice a representative just doesn’t provide.

To become a financial advisor, the bar is higher. Many advisors hold certifications like CFP (Certified Financial Planner), Series 65 or 66 licenses, or other specialized designations. These aren’t just fancy letters, they mean the advisor has been trained in investments, tax strategies, and financial planning. When I met my first CFP, it was clear they weren’t just winging it. They had the technical training to back up their advice.

Here’s where things really matter: many financial advisors operate under a fiduciary standard. That’s a fancy way of saying they’re legally required to act in your best interest. Compare that to a representative, who only has to make “suitable” recommendations. The difference is huge. If you’ve ever wondered why some people swear by their financial advisor, it’s often because of this fiduciary duty, it builds trust.

At the end of the day, a financial advisor looks at the big picture. They aren’t just pushing one insurance policy or a single investment. Instead, they act like a coach, helping you balance short-term needs with long-term goals. That’s why people often stick with the same advisor for decades. Personally, I’ve learned that working with an advisor feels more like having a partner in the process, while working with a representative feels more like a transaction.

So if you’re debating between the two, think of it this way: a financial representative can sell you a single piece of the puzzle. A financial advisor helps you put the entire puzzle together.

The more I dug into this topic, the more I realized how easy it is to confuse the two. I used to think they were basically the same, someone who “helps with money.” But once I started comparing side by side, the differences became too big to ignore. It’s kind of like comparing a cashier to a nutritionist. Both deal with food, but one sells you the item while the other helps you build a full meal plan.

A financial representative usually sticks to products, insurance, retirement accounts, or mutual funds tied to their company. Their scope is narrow because they’re limited to what their employer offers. On the flip side, a financial advisor often looks at everything. When I worked with an advisor, we talked not just about investments but also about budgeting, estate planning, and even tax strategies. That broader perspective is the biggest difference.

This was a game-changer for me. Financial representatives are usually paid through commission. That means they earn money when you buy the product they’re offering. Advisors, on the other hand, are often fee-based or fee-only. They might charge a flat fee, a percentage of assets they manage, or an hourly rate. Knowing how someone gets paid makes it much easier to see if their advice is truly aligned with your goals, or their paycheck.

This one’s huge. A financial advisor working under the fiduciary standard must put your interests first, even if it means recommending something they don’t profit from. Financial representatives don’t usually operate under that standard they just have to recommend something “suitable.” I once had a rep try to sell me an insurance policy that was technically “suitable,” but my advisor later showed me it wasn’t the best option. That difference in duty can really impact your wallet.

When I think back, every conversation with a financial representative felt short-term. “Here’s a product that fits your current situation.” Advisors, on the other hand, ask where you want to be in 5, 10, or even 30 years. That’s long-term guidance. It feels more like building a road map instead of buying a ticket for a single bus ride.

Trust is tricky in finance. With financial representatives, I often found myself second-guessing whether they were showing me the best option or just the one they could sell. With advisors, especially those who explain their fees upfront, it felt more transparent. That doesn’t mean every advisor is perfect, but the structure of their role naturally encourages more openness.

At the end of the day, the differences boil down to this: a financial representative is a salesperson with a license, while a financial advisor is a planner with a duty to act in your best interest. Both can play a role in your financial journey, but knowing the distinctions helps you avoid walking into a meeting with the wrong expectations.

I’ll be honest, there was a time when I didn’t think I’d ever need a financial representative. I figured, “Why not just skip to an advisor?” But in reality, there are situations where a rep is actually the right person to talk to. I learned this the hard way when I tried to buy a life insurance policy directly online, only to get completely lost in the fine print. A representative stepped in, explained the jargon, and handled the paperwork for me. It wasn’t a bad experience at all, just different from working with an advisor.

If your needs are very product-focused, a financial representative can be exactly who you want. For example, buying life insurance, setting up a disability policy, or opening a retirement account through a specific investment company. They’re specialists at connecting you with their company’s offerings, and that can actually save time. I once worked with a rep to get supplemental life insurance through my employer, and it was way faster than trying to shop around on my own.

Another reason to go with a representative? Cost, or really, the lack of upfront cost. Most reps don’t charge you a fee to meet with them. Instead, they make money off the commission from selling a product. That can feel like a win if you’re on a tight budget and don’t want to pay advisor fees. But the trade-off is that their advice might lean toward the products that earn them more commission. I learned to always ask, “Are there other options I should be considering?”

The best thing you can do is go into the conversation with your eyes wide open. Here are a few questions I’ve found super helpful:

Asking these up front can save you from feeling blindsided later. The first time I asked about commissions, the rep looked a little surprised, but he answered honestly. That moment gave me way more confidence in moving forward.

In short, a financial representative is a good fit if you know exactly what you need and just want help buying it. They can simplify the process, take care of the paperwork, and answer product-specific questions. Just keep in mind, they’re there to sell, not to map out your entire financial life.

I’ll never forget the first time I sat across from a financial advisor who asked me, “Where do you see yourself at 65?” I laughed nervously because I hadn’t really thought that far ahead. That question hit me hard, and it showed me exactly why advisors exist. They don’t just handle a single product; they help you shape a whole strategy. There are plenty of times when going with an advisor instead of a representative makes way more sense.

If you’re thinking about retirement, investing beyond your 401(k), or creating a plan to pass wealth down to your kids, that’s advisor territory. When my dad wanted to figure out how to draw income from his retirement accounts without paying too much in taxes, a financial advisor laid out a withdrawal strategy step by step. That’s not the kind of thing a representative is set up to do. Advisors are also great if you’ve got multiple financial goals happening at once, like saving for college while still building your retirement.

Yes, advisors cost more than representatives. You might pay a flat fee, a percentage of your assets, or an hourly rate. I used to cringe at the idea of paying someone hundreds of dollars for advice. But then I realized that one piece of tax guidance they gave me saved me thousands. That’s when the value clicked. With reps, the cost is hidden in the products; with advisors, the cost is upfront, but so is the value.

Not all advisors are created equal, and I learned that the hard way. Here are a few warning signs I wish I’d paid attention to sooner:

The best advisors I’ve worked with were the ones who didn’t sugarcoat things. They’d say, “Yes, this investment could grow, but here’s what you’d lose if the market dips.” That honesty built trust faster than any sales pitch ever could.

At the end of the day, you work with a financial advisor when your needs go beyond a single purchase. If you’re building wealth, protecting your family’s future, or just want someone to keep you accountable over the years, that’s when an advisor earns their keep.

I used to think choosing between the two was like flipping a coin. Either one could “help with money,” right? But once I actually worked with both, I realized the decision comes down to knowing your goals, your budget, and how much guidance you really want. The clearer you are on those things, the easier it is to pick the right person.

Here’s the framework I started using whenever I had to make the call:

That simple process has saved me a lot of stress and confusion.

When I was younger, my goals were small, open a savings account, buy a bit of insurance, and call it a day. A financial representative handled that just fine. But as I started thinking about retirement, investments, and taxes, the rep couldn’t give me what I needed. That’s when I knew it was time for an advisor. Think about where you are now, but also where you want to be five or ten years down the road.

The money side is where most people (including me) get tripped up. With reps, the cost is built into the products, so it feels “free.” With advisors, you see the fee upfront, and that can be intimidating. But here’s what I’ve learned: paying for good advice can sometimes save you more than the fee itself. I once balked at a $500 advisor fee, but the strategy they gave me ended up saving me nearly $2,000 in taxes. That’s when the math started making sense.

I used to walk into these meetings unprepared. Now, I always go in with a list:

The way they answer these questions tells you almost everything. If they dodge, overcomplicate, or get defensive, that’s a red flag. If they’re open and straightforward, you’re probably in better hands.

In the end, deciding between a financial representative and a financial advisor isn’t about which one is “better.” It’s about which one is better for your specific situation right now. I’ve worked with both at different stages, and each played the right role at the right time.

At the end of the day, the choice between a financial representative and a financial advisor isn’t about right or wrong, it’s about fit. If you need a straightforward product like life insurance or a retirement account starter, a representative might be exactly who you need. But if you’re looking for deeper guidance, someone to help you balance investments, taxes, and long-term planning, an advisor is usually the better match.

What helped me most was realizing I didn’t have to pick one forever. As my goals grew, so did the kind of support I needed. Your financial journey will shift too, and that’s okay. The key is knowing where you are now and being honest about the kind of help that will actually move you forward.

So whether you start with a rep, an advisor, or even just a few Google searches, the most important step is taking action. Because no matter who you work with, the earlier you start shaping your financial future, the more options you’ll have when it really counts.

Want to dive deeper into financial topics? Check out our other guides: