Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Can I be honest for a sec? The first time I used the Dave Ramsey investment calculator; I got kind of emotional. Seeing those future numbers, how much my money could grow over time, was wild. And honestly, a little motivating.

If you’re even a little into personal finance, chances are you’ve heard Dave Ramsey talk about the power of compound interest. He calls it “the eighth wonder of the world” (okay, Einstein said that first, but Dave definitely runs with it). His investment calculator is designed to help everyday folks visualize their long-term goals without needing a finance degree. It’s one of those tools that looks simple… but packs a punch.

The catch? It assumes a 12% return, which is where things get interesting. Some people love that number. Others? Not so much.

In this article, I’ll break down what the calculator actually does, how to use it properly, and when it might be a little too optimistic. I’ve spent hours fiddling with it, comparing it to other calculators, and using it to map out my own goals. Along the way, I’ve picked up a few tips, and made a few mistakes, I wish someone had warned me about. So, let’s dig in and figure out if this tool is hype or genuinely helpful.

I stumbled across this tool during a budgeting spree. I was deep into Dave’s books and figured, why not give it a try?

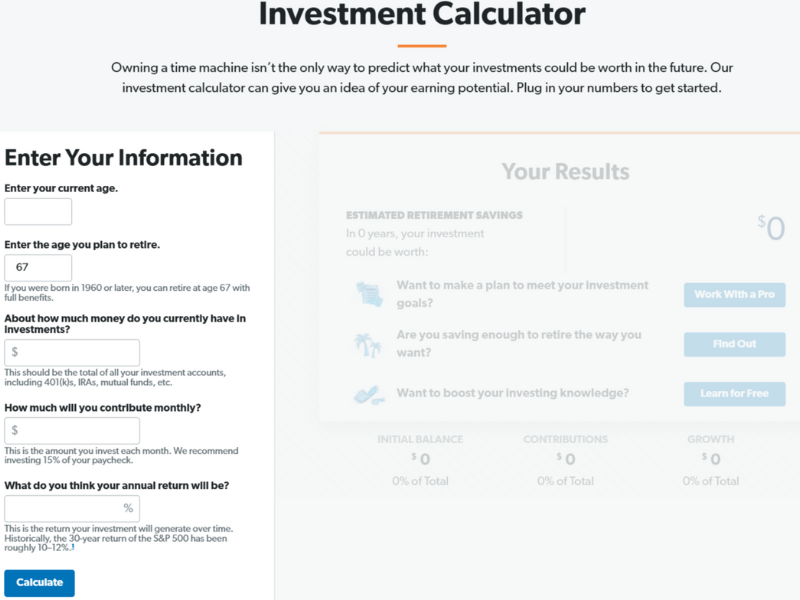

The Dave Ramsey investment calculator is a free tool on RamseySolutions.com that helps you estimate how much your investments could grow over time. You input a starting amount, a monthly contribution, and how many years you plan to invest. It then calculates your total investment, projected interest, and the final future value.

It’s part of Ramsey’s broader philosophy of long-term, disciplined investing. The calculator’s simplicity is what makes it popular, it’s visual, beginner-friendly, and doesn’t require you to know a single thing about finance formulas.

There’s no mobile app (yet), but it works smoothly on your phone or laptop. If you’re following Dave’s 7 Baby Steps, this ties directly into Step 4: Invest 15% of your household income. It’s not flashy, but it does what it’s meant to do, make you believe that saving now pays off later.

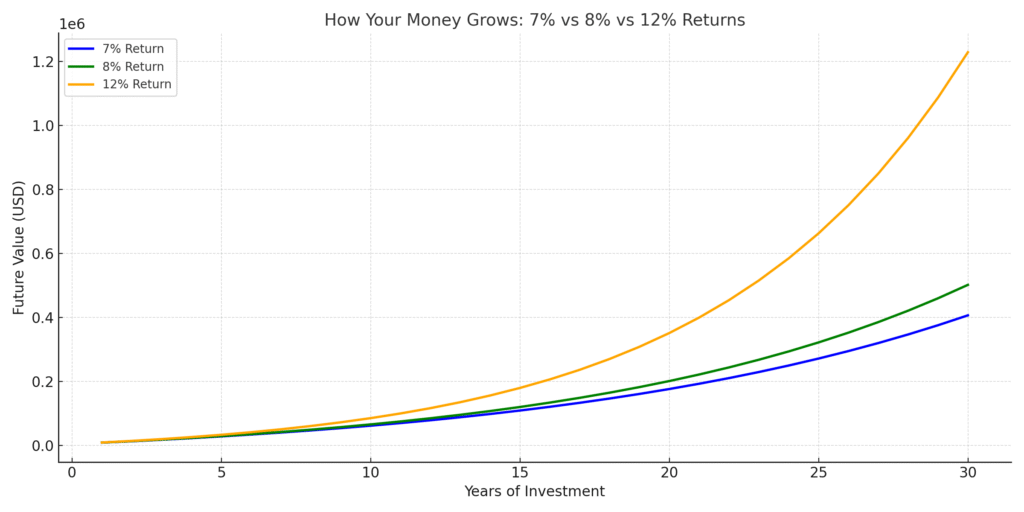

So here’s where things get spicy. The calculator assumes a 12% average annual return on your investments. Yup, you read that right, twelve. Not 7%. Not 8%. That high number is what gets a lot of folks excited… and others skeptical.

Here’s the math in plain English:

Basically, it takes your starting balance, adds your monthly contributions, and compounds it all monthly using the assumed interest rate.

Now, here’s where it gets tricky: 12% is based on historical returns of the S&P 500, which have averaged around that number over long time spans. But that’s before inflation and not guaranteed year to year.

If you’re trying to be conservative, I’d run the same numbers with 7% or 8% in a separate calculator just to be safe.

It’s super easy. Here’s how I’ve used it step by step:

Boom. You’ll get a big, bold number showing what your investment could grow to, sometimes in the hundreds of thousands or even millions.

You’ll also see a simple breakdown:

The first time I saw my 25-year projection was over $1 million. That was… intense. But it helped me realize how small monthly habits make a massive difference.

Tip: Run different versions of your plan. Add in salary raises. Change your monthly amount. It’s very satisfying to watch those numbers climb.

Here’s the honest truth: 12% is aggressive. It’s not fake, but it’s not a sure thing either.

The stock market’s long-term average since the 1920s has hovered between 10% and 12%, depending on how you measure. But that’s gross return, before fees, taxes, or inflation. Once you factor those in, you’re often looking at a real return closer to 7% or 8%.

Also, markets go through cycles. A couple of rough years can throw off short-term results, even if long-term growth stays strong. And in 2025, with inflation and global uncertainty still part of the picture, many financial advisors recommend planning with more conservative estimates.

Still, if you’re investing in low-cost index funds and sticking with it over decades, aiming for 10% to 12% isn’t out of the question. Just don’t bet the farm on it.

I’ve found this tool most useful for goal setting.

Here’s what I recommend:

It also helps with motivation. When I’m tempted to skip a month of investing, I plug in the numbers again, and seeing the lost potential usually snaps me out of it.

Here’s my take after months of using it:

Pros:

Cons:

If you want a pure visual motivator, it’s fantastic. But for precise financial planning? You’ll want a more detailed calculator or a CFP’s help.

If you’re looking for calculators with more control or realism, check these out:

Each one has its pros and cons. Ramsey’s is the simplest, but sometimes simplicity comes at the cost of nuance.

If you’re new to investing or just trying to get excited about your financial future, the Dave Ramsey investment calculator is a great place to start. It’s fast, free, and actually kind of fun. You’ll leave feeling more hopeful, and sometimes that’s half the battle.

Just keep in mind that it’s not a full-blown financial planner. It won’t account for taxes, inflation, or market volatility. And yes, that 12% number might be too optimistic for some people.

Still, it’s helped thousands of people start investing, stay consistent, and aim high. Use it as a launchpad, not the final word. Then check in with more advanced tools (or a human advisor) when you’re ready to fine-tune your plan.

Now go ahead, plug in your numbers. Future you will be glad you did.

Check out our latest blogs on Smart Budgeting