Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ever heard someone call grants “free money” and thought, what’s the catch? You’re not alone! In fact, a recent survey showed that over 40% of students are confused about whether financial aid like grants must be repaid. The truth is, most grants don’t need to be paid back, but there are exceptions, and missing those details could cost you. So, do you have to pay back grants?

In this article, we’ll break down the types of grants, when repayment might be required, and how to make sure you keep every dollar you’ve been awarded. Whether you’re a student applying for financial aid or a small business owner chasing government grants, understanding repayment rules can save you a lot of stress.

Grants are often described as “free money,” but that’s only half the story. At their core, grants are funds provided by the government, schools, or private organizations to help pay for education, business projects, or research. Unlike loans, grants don’t usually require repayment as long as you follow the rules that come with them. Think of them as a financial boost meant to help you succeed without creating debt hanging over your head.

A grant is money you’re awarded to cover specific costs, like tuition, housing, starting a small business, or even running community programs. The key word here is awarded; you don’t borrow it. Most of the time, if you stick to the conditions, you’ll never have to worry about giving the money back. For example, a Pell Grant helps low-income students cover college expenses, while a small business innovation grant can help entrepreneurs test new ideas without going into debt.

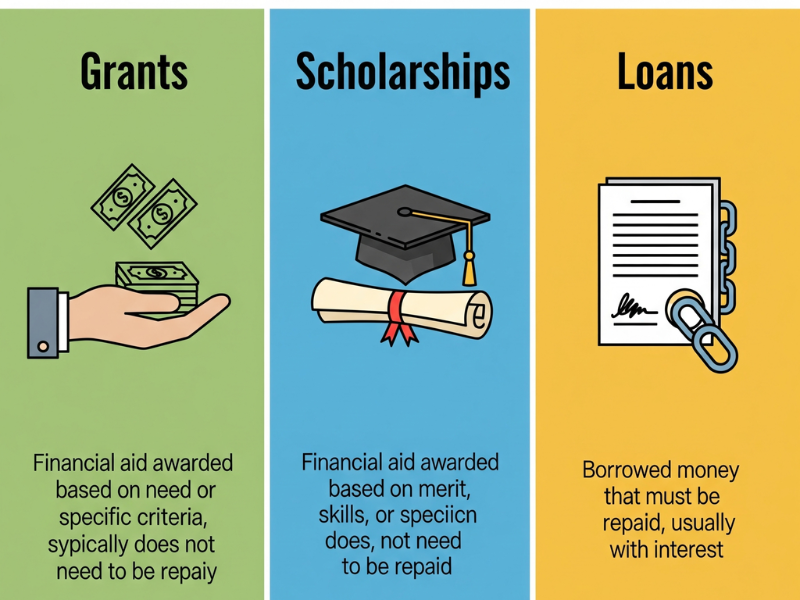

It’s easy to mix these up, and I remember doing it myself when I applied for financial aid in college. Grants are usually based on financial need, while scholarships often reward merit, like strong grades, sports, or community service. Loans, on the other hand, always need to be paid back, with interest, which can make them way more expensive over time.

Here’s how I like to think of it:

The tricky part is, some grants can turn into loans if you don’t meet conditions, like with the TEACH Grant. That’s why it’s smart to know exactly what category your funding falls under before spending it.

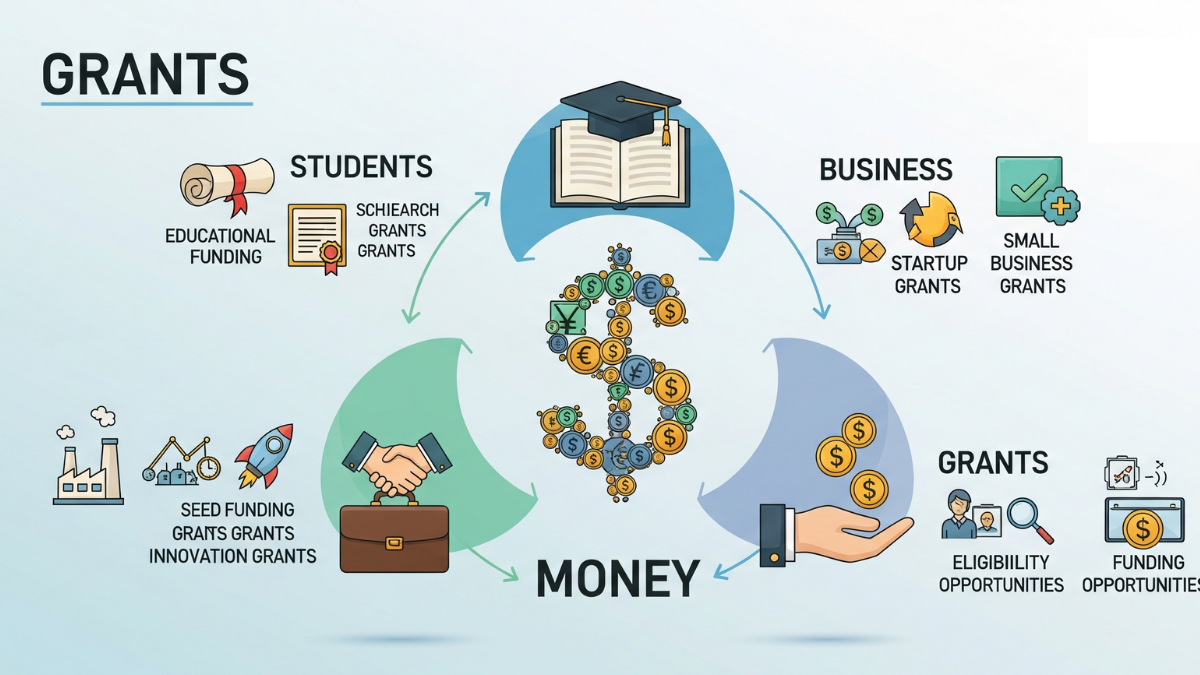

Grants aren’t just for college students. They cover a wide range of people and projects. Students often get education grants from federal or state programs. Nonprofits apply for grants to fund services like after-school programs, food distribution, or environmental projects. Small businesses can apply for government or private grants to expand operations or develop new products. And researchers, whether in health, technology, or social sciences, often rely on grants to fund studies that push knowledge forward.

When I worked with a small community nonprofit, I saw firsthand how crucial grant money was. Without it, we wouldn’t have been able to keep certain programs running. But I also saw how competitive and strict grant applications can be. It’s not just about free money; it’s about meeting specific goals and showing you can use the funds responsibly.

The good news? Most grants don’t have to be repaid. That’s why people often call them “free money.” But, and it’s a big but, there are exceptions. If you don’t follow the conditions attached to the grant, you could end up owing some or even all of it back.

For the majority of students, businesses, and nonprofits, grants are awarded with the expectation that they’ll be used responsibly. When I got my first college grant, I was honestly shocked at how straightforward it was. The school deposited the funds into my account for tuition and fees, and that was it. No repayment plan, no monthly bill. As long as I stayed enrolled and used the money for school-related costs, I didn’t owe a dime.

This is what makes grants so appealing. They reduce financial stress without adding debt. For students, Pell Grants and state aid programs are the most common examples. For organizations, it might be a federal program supporting community projects. In almost every case, you won’t be expected to repay as long as you meet the terms.

Here’s where people get tripped up. Grants can come with strings attached. For example, if you accept a TEACH Grant but later decide not to teach in a low-income school for the required time, the grant converts into a loan. Suddenly, you’ve got a repayment obligation you weren’t planning for.

I also had a friend who lost part of her grant money after dropping below half-time enrollment. Since the money was awarded based on her being a full-time student, the school asked for a portion of it back. It wasn’t fun, and it taught me to always read the fine print.

Other common triggers for repayment:

One of the biggest myths out there is that all grants are just free cash you can spend however you like. Not true. Every grant comes with an agreement, whether it’s to maintain grades, stay enrolled, or report back on how the funds were used.

Another myth is that grants are guaranteed once awarded. In reality, they can be revoked if you don’t hold up your side of the deal. I’ve seen small nonprofits lose grants because they didn’t submit required progress reports. It wasn’t fraud or anything shady, it was just oversight, but the money had to be returned.

So yes, grants are typically free money, but they’re not a free-for-all. Think of them as trust: the provider gives you funds to accomplish a specific goal, and you need to prove you used them the way you said you would.

Most of the time, grants really are free money. But there are certain scenarios where you could be asked to give some or all of it back. I’ve seen people blindsided by this, not because they were irresponsible, but because they didn’t realize the rules attached. Knowing these situations upfront can save you a lot of stress later.

If you get a Pell Grant and then drop out mid-semester, you might owe a portion of it back. Schools calculate your eligibility based on how long you were enrolled. I had a classmate who left college two months into the term, and the financial aid office sent her a notice that she owed a few hundred dollars back. It wasn’t fun, and she admitted she didn’t even know that was a possibility.

Grants often come with academic performance standards. If you fail too many classes or don’t maintain the minimum GPA, your future grants could be canceled. In some cases, you might have to return money already disbursed. I remember struggling in one course and panicking about my GPA because my entire aid package depended on it. The stress alone made me laser-focused on getting tutoring.

Enrollment status matters too. Many grants require you to stay at least half-time in school. Drop to part-time, and you could trigger repayment rules.

Grant money usually comes with clear instructions about what it can cover. For students, that’s tuition, books, housing, or other education-related costs. For businesses, it might be equipment or research, but not personal expenses.

I once heard about a nonprofit that used part of its grant to pay for a fancy staff retreat. The funder found out and demanded repayment because it wasn’t in the approved budget. That’s a tough lesson, spend it the wrong way, and you might have to give it back.

Organizations that receive grants often have to submit reports proving how the money is being used. If they don’t, or if the money is mismanaged, repayment can be required. It’s not always fraud, it can simply be missed deadlines or sloppy record-keeping.

One of the nonprofits I volunteered with had to scramble to pull together receipts because the grantor wanted proof of spending. Luckily, they were able to show everything was above board, but it taught me how strict compliance can be.

This one’s obvious but worth saying: if you lie on your application, you’re risking repayment and possibly even legal trouble. That could mean inflating your income details for a student grant or exaggerating business expenses for a small business grant.

Even unintentional errors can cause problems. I once miscalculated my income on a FAFSA application, and although it wasn’t fraud, I had to go back and fix it to avoid losing my aid package. Honesty and accuracy really do matter here.

Federal student grants are probably the most common type of aid people hear about, especially Pell Grants. And while they’re often described as “free money,” the fine print matters. Each program has its own set of rules, and slipping up on any of them can flip a grant into a repayment obligation. I’ve seen it happen, and it’s not pretty.

Pell Grants are awarded based on financial need. The best part is they don’t need to be repaid, unless something changes with your enrollment status. For example, if you drop classes or withdraw early in the semester, you might owe back part of the funds you already used.

When I was in college, one of my roommates withdrew from half her classes after getting her Pell Grant. A few weeks later, she got a letter from the school saying she had to return nearly $800. She was shocked, she thought grants were guaranteed. The reality is that schools recalculate eligibility when your course load changes.

The TEACH Grant sounds amazing at first glance: up to $4,000 a year if you commit to teaching in a high-need field at a low-income school. But here’s the catch, if you don’t meet that teaching requirement for four years, the grant converts into a loan with interest.

I knew someone who accepted the TEACH Grant with every intention of fulfilling the obligation. Life happened, and she switched careers. Within months, all her “grants” had been reclassified as loans, and suddenly she was staring at thousands of dollars in debt. The TEACH Grant is one of those programs where you absolutely need to be 100% sure you can meet the conditions.

It’s not just federal programs. Many states offer grants with their own rules. Some require you to work in the state after graduation. Others require you to maintain a certain number of credits.

I once applied for a state grant that required staying in-state for a year after graduation. At the time, it sounded fine. But I later realized how binding it would’ve been if I wanted to move for a job. That experience made me double-check every grant’s terms before accepting.

The best way to keep your grants safe is to stay organized and proactive. A few things that worked for me:

A friend once called her financial aid advisor after considering a course withdrawal, and the advisor helped her adjust her schedule without triggering repayment. That call saved her hundreds of dollars. Sometimes just asking can make all the difference.

Grants for businesses and nonprofits can feel like a lifeline, especially when money is tight. They often come from government programs, foundations, or private organizations that want to support growth, innovation, or community services. But here’s the thing: while they don’t usually require repayment, certain missteps can put you on the hook for giving the money back. I’ve seen it happen to nonprofits I’ve volunteered with, and the fallout can be brutal.

Small business owners often apply for grants to cover startup costs, expand services, or fund research and development. Government programs like SBIR (Small Business Innovation Research) or private foundation grants are competitive but incredibly valuable.

The catch? These grants usually come with strict guidelines about how the money is used. Spend it outside the approved scope, and you could be forced to repay. A friend of mine got a local business grant meant for equipment upgrades. When she used part of it for marketing instead, the grant committee asked for that portion of the funds back. Lesson learned: always stick to the budget categories you’re approved for.

Businesses and nonprofits are almost always required to submit progress or financial reports. These aren’t optional, they’re part of the deal. I remember helping a nonprofit draft one of these reports, and the detail they wanted was intense: receipts, time logs, project milestones, the works.

If an organization fails to report on time or leaves out key documentation, the grantor can withhold future funds or demand repayment. It’s not usually about dishonesty; it’s often about poor record-keeping or missed deadlines. Still, the consequences can be just as damaging.

Repayment usually happens if:

One nonprofit I worked with almost had to return money because their program closed earlier than expected. They ended up negotiating with the grantor to keep part of the funds since some deliverables were met, but it was a tense process that could have gone the other way.

I once read about a nonprofit that used federal grant money to cover staff bonuses instead of program costs. When auditors caught it, the organization had to repay thousands and lost eligibility for future grants. For small organizations, that kind of clawback can be devastating.

On the business side, I’ve heard of startups that had to return innovation grants when they couldn’t provide proof that their research actually progressed. Even though the entrepreneurs weren’t dishonest, they just didn’t deliver results, and the grant terms required repayment.

The bottom line? Business and nonprofit grants can be a huge help, but they’re not “no-strings-attached.” If you’re applying for one, know exactly what you’re committing to, and keep meticulous records from day one.

Getting a grant is exciting but keeping it safe is all about discipline. The good news? Most repayment situations can be avoided if you’re proactive. Think of it like guarding a gift, you just need to follow the rules that come with it.

Before you sign anything, go through the grant agreement carefully. Highlight repayment clauses, reporting deadlines, and any restrictions on spending. If something feels vague, don’t be afraid to ask the grantor for clarification. I’ve seen people skim over contracts only to realize later that they agreed to stricter conditions than they expected.

Once you’ve got the grant, use the funds exactly as outlined in your proposal. If your budget said “equipment,” don’t try to sneak in advertising costs or travel expenses. Even small deviations can trigger red flags during an audit. A trick I recommend: open a separate bank account for grant money. That way, every transaction is clearly tied to the award.

Save receipts, invoices, timesheets, everything. Many organizations lose grants not because they misused funds, but because they couldn’t prove how the money was spent. Digital folders and cloud storage can make this painless. Think of your records as a safety net that protects you if questions come up later.

Reporting deadlines matter just as much as spending rules. Put them on your calendar, set reminders, and don’t wait until the last week to prepare. If you need an extension, ask early. Most grantors are more flexible when you communicate in advance rather than scramble after a missed deadline.

If something changes, your project ends sooner than planned, your expenses shift, or you hit a snag, let the grantor know right away. Many times, they’ll work with you to adjust expectations instead of demanding repayment. Silence, on the other hand, makes it look like you’re hiding something.

At the end of the day, grants aren’t just free money. They’re investments in your work or your future. If you treat the relationship with professionalism and transparency, you’re far less likely to face repayment issues.

So, do you have to pay back grants? Most of the time, no. Grants are meant to support you, not weigh you down with debt. But as you’ve seen, repayment can come into play if the rules are ignored, deadlines are missed, or circumstances change.

The best way to protect yourself is simple: read every condition before accepting, stay organized, and treat the money with care. Whether it’s a federal student grant, a nonprofit award, or a small business grant, the principle is the same, follow the guidelines and you get to keep the funds without stress.

Think of grants as opportunities, not obligations. If you respect the terms and stay proactive, you’ll never have to worry about giving that money back. Instead, you can focus on putting it to work and moving forward with your goals.

Want to dive deeper into financial topics? Check out our other guides: