Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

“How long does it take to get a student loan?” is one of the most common questions students ask when planning for tuition. With college costs rising each year, timing your loan application can make or break your semester budget. According to Education Data Initiative, the average student loan debt in the U.S. is now over $37,000, which makes understanding the loan process even more crucial!

In this guide, I’ll walk you through the entire student loan timeline, from filling out applications to finally seeing the funds deposited in your account. Whether you’re applying for federal or private student loans, you’ll know what to expect, how to avoid delays, and when your money will actually arrive.

Federal student loans move on their own timeline, and honestly, it feels slow when you’re waiting for the money to hit. The entire process depends on a mix of the FAFSA, your school’s financial aid office, and federal disbursement rules. Knowing how each piece works makes it easier to plan ahead so you’re not panicking before tuition is due.

The FAFSA is where it all starts. If you file it early, say October when the application opens, you’ll usually hear back faster. But if you wait until the deadline, the processing and verification can take weeks longer. I once filed mine late in the spring, and by the time everything cleared, the semester was almost starting. So, timing matters. The earlier you submit FAFSA, the earlier your school can calculate your aid package and confirm your loans.

On average, it takes about 3–5 days for the Department of Education to process your FAFSA if you file online. Paper applications can take 7–10 days or even longer. After processing, your Student Aid Report (SAR) is sent to you and your school. That’s when the waiting game really begins, because the school has to review it before you see actual loan details. In my case, I always budgeted about 2–3 weeks from FAFSA submission to getting a final aid offer.

This is the part many students don’t realize: even though your FAFSA is approved, your school’s financial aid office controls when funds are released. They verify your enrollment status (usually at least half-time), check for holds on your account, and make sure you meet all requirements. I remember getting a surprise delay one year because I forgot to submit a verification form the office asked for. That little slip-up cost me almost a month. The school is essentially the gatekeeper between federal approval and your tuition bill being paid.

Federal loans are typically disbursed at the start of each semester, not all at once. Your school applies the loan money directly to tuition, fees, and housing costs first. If there’s money left over, you’ll get a refund check or direct deposit. That refund usually shows up a week or two after classes start. I used to rely on those refunds for books, and let me tell you, it’s not fun when they’re late. Some schools also split disbursements into two payments per semester, so don’t be shocked if the money doesn’t arrive all at once.

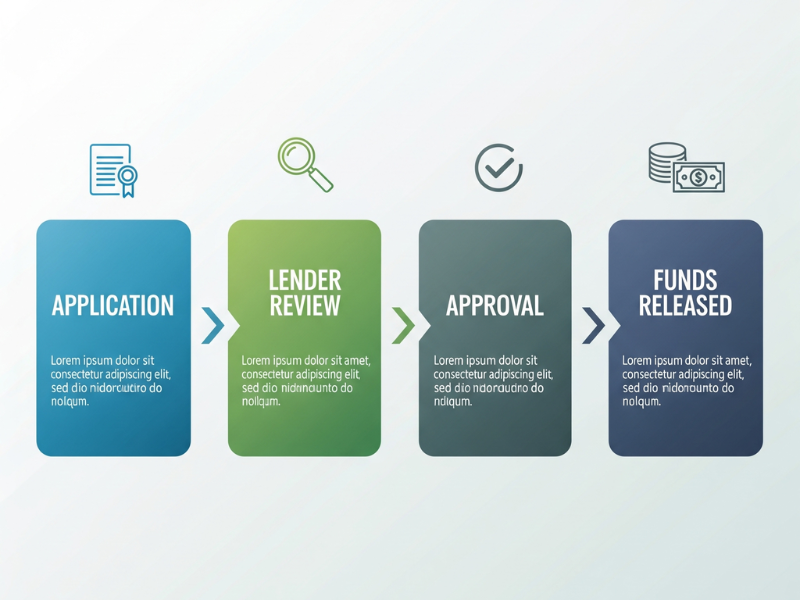

Private student loans move faster than federal loans, but there are still a few hoops to jump through. Lenders treat them more like traditional loans, so approval depends heavily on your credit history, your cosigner (if you need one), and how quickly you get your paperwork in order. I’ve seen friends get approved in a single afternoon, while others waited weeks because of missing documents.

Most private lenders let you apply online in under 30 minutes. The forms usually ask for your income, school info, Social Security number, and sometimes proof of enrollment. When I applied for my first private loan, the whole thing felt almost like filling out a credit card application, it was quick, but nerve-wracking because you’re waiting to hear if you “qualify.” The real time factor comes afterward, when the lender verifies your info.

Some lenders give you a conditional decision the same day, especially if you have good credit or a cosigner with strong financials. Others take 2–7 business days to review the application in detail. I’ve noticed banks and credit unions usually take longer than online lenders because their approval process isn’t as automated. So if you’re in a rush, those fintech-style lenders might be the better bet.

Here’s where things can drag. If you need a cosigner, the process only moves as fast as they do, so if they take three days to upload their ID, that’s three days you’re stuck waiting. Credit checks can also add time, especially if something pops up that requires further review. And don’t even get me started on missing documents. One time, a friend forgot to upload proof of enrollment, and it pushed her approval back by almost two weeks. Double-checking your file before hitting submit saves a lot of frustration.

Once you’re approved, don’t expect money in your account right away. Most lenders send funds directly to your school, and the school applies them toward tuition and fees. This process can take another 1–2 weeks. If there’s leftover money, your school refunds it to you, usually by direct deposit if you set that up. I’ve had cases where the loan was approved in three days, but I didn’t see the refund check until nearly a month later because the school had to clear it first.

Even if you do everything right, student loans can still take longer than expected. A lot of the timing comes down to little details that people often overlook. I’ve learned the hard way that one small mistake, like a typo on the FAFSA, can snowball into weeks of delay.

This one gets a lot of students. If your FAFSA is missing info, or if you typed in the wrong Social Security number, the Department of Education will flag it. The fix is simple; you just have to correct it online, but the processing clock basically resets. I remember fixing an error on mine and thinking, “It’s just one number, how bad could it be?” Well, it added almost two weeks to the wait time.

Sometimes you get selected for something called “verification.” It’s not random schools often pick students when information on the FAFSA doesn’t fully match IRS data or looks incomplete. If you’re chosen, you’ll need to provide extra documents like tax returns, W-2s, or proof of income. I had a friend who got stuck in verification and didn’t get her loan disbursed until mid-semester. The key is to respond fast when your school asks for documents, because delays here can really mess up your funding timeline.

Every school runs on its own schedule. Some release funds right before the semester starts, while others wait until classes have already begun. I once attended a school that wouldn’t release refunds until two weeks into the semester, no matter when the loan cleared. It drove students crazy, especially those who needed the refund for rent or books. Checking your school’s financial aid calendar in advance can save you from being blindsided.

Even after the school finally releases your refund, the bank can cause more delays. Direct deposit usually takes a day or two, but paper checks can drag on for a week or more depending on mail and bank clearing times. I still remember standing in line at the bank with a paper refund check, praying it wouldn’t take another three business days to clear. If possible, always opt for direct deposit, it cuts down a lot of the waiting.

Waiting for student loan money can feel like forever, especially when bills and tuition deadlines are staring you down. The good news is there are ways to cut down the wait time. Over the years, I’ve picked up a few tricks that saved me from unnecessary stress (and late fees).

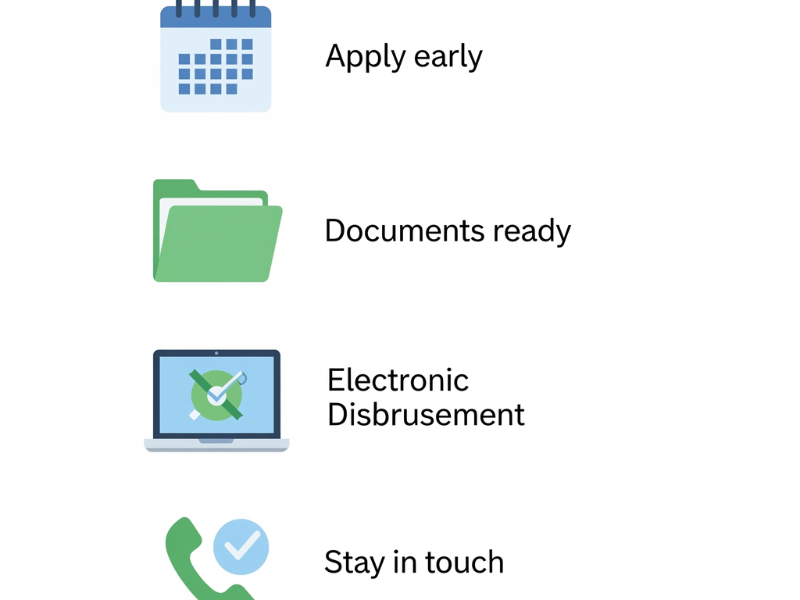

The single best thing you can do is apply early. FAFSA opens in October for the next school year, and the earlier you file, the quicker your aid package is set up. I learned this lesson the hard way my freshman year when I applied in June and spent most of July refreshing my email for updates. For private loans, applying a month or two before tuition is due gives you breathing room in case anything slows down the approval.

Most delays come from missing paperwork. I now keep a folder with my tax returns, proof of income, Social Security card, and school enrollment docs. That way, I’m not scrambling when the financial aid office or lender emails asking for something. One year, I had to track down my mom’s W-2 from three years prior, it was a nightmare that stretched the process by nearly three weeks. Having everything ready upfront is a lifesaver.

If your school gives you the option, go with direct deposit every time. Paper checks are slower, easier to lose, and take longer to clear at the bank. Once I switched to electronic refunds, I got my leftover funds in 1–2 days instead of 7–10. It might not sound like a big deal, but when you need money for books or rent, those extra days matter a lot.

Don’t assume “no news is good news.” If you haven’t heard anything in a while, follow up. I once found out my loan was stuck because the financial aid office was waiting on a form, they claimed they emailed me (I never got it). A five-minute phone call cleared it up. The same goes for private lenders, sometimes an application just needs one small update, and calling saves you days of waiting.

Few things are more stressful than expecting loan money that just doesn’t show up on time. I’ve been there refreshing my bank account every morning, emailing financial aid, and stressing about late fees. The good news? You’ve got options while you wait.

Most schools offer short-term payment plans if your aid hasn’t come through yet. I once broke my tuition bill into three smaller payments just to avoid being dropped from classes. Some campuses also have emergency aid or short-term loans for situations like this, basically a small cash advance against your pending loan. And don’t forget scholarships; I snagged a last-minute book scholarship once that helped bridge the gap while my federal refund was delayed.

If your loan is stuck, don’t just sit there hoping it’ll work itself out. Call or email your lender and your school’s financial aid office. More often than not, delays happen because one small document is missing, or a box wasn’t checked. I once waited two weeks only to find out the office needed me to sign a Master Promissory Note. One signature, and boom, the process moved forward.

When all else fails, talk to your school about deferment. Some colleges let you start classes while your loan is being finalized, as long as they can confirm the aid is on the way. I had to do this one semester when my verification dragged on forever. It was nerve-wracking, but at least I wasn’t locked out of classes. Schools don’t want to lose students over paperwork delays, so they’ll often work with you if you’re upfront about the situation.

At the end of the day, student loans don’t move at lightning speed. Federal loans can take weeks because of FAFSA reviews and school disbursement schedules, while private loans are quicker but still depend on paperwork and approvals. The key is planning ahead. Apply early, double-check every form, and keep in touch with the people handling your money.

And while delays can feel overwhelming, they don’t have to derail your semester. Schools usually have backup plans, payment options, emergency aid, or deferments, so you’re not left stranded. Think of it like a test of patience: the system might move slower than you’d like, but once the funds finally land, the stress lifts fast.

So, if you’re staring at deadlines and waiting on that deposit, take a breath. Prep what you can, ask for help when you need it, and remember, most students go through the same wait. The smart ones are just the ones who plan for it.

Want to dive deeper into financial topics? Check out our other guides:

It depends on the type of loan. For federal loans, the process can take a few weeks from the time you submit your FAFSA to when your school processes it. Private lenders may approve and fund a loan in just a few days, though it can also take up to a few weeks depending on your application.

Federal student loan approval usually happens within two to three weeks after you’ve submitted your FAFSA. Private student loan approval can be much faster, sometimes within 24–48 hours, but disbursement may still take a few days.

Federal student loans are typically disbursed at the start of each semester. Private student loans are often disbursed within a week of approval, but the exact timing depends on your lender and school.

Delays happen if your FAFSA is incomplete, if additional documents are required, or if your school’s financial aid office has a backlog. With private student loans, extra time may be needed for credit checks or cosigner verification.

If you apply close to the start of the semester, federal loans may still take several weeks to process, which could delay your disbursement. Private loans may be quicker, but you should still apply at least a month before tuition is due to avoid stress.

Some private lenders advertise same-day or next-day student loan funding. However, federal student loans cannot be processed that quickly. If you’re asking how long does it take to get a student loan in an emergency, private lenders are usually your fastest option.

Apply early, submit all required documents right away, and stay in contact with your lender or financial aid office. This can help cut down how long it takes to get a student loan and ensure your funds arrive on time.