Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

“Did you know that in the U.S. alone, student loan debt has surpassed $1.7 trillion?!” For many students, loans are the only way to bridge the gap between their financial reality and their education dreams. Figuring out how to get student loans might feel overwhelming, but the process becomes much easier once you break it down step by step. In this guide, we’ll cover everything from understanding your options to applying, managing, and repaying loans wisely. Whether you’re just starting college or thinking about grad school, this guide will give you the knowledge and confidence to navigate the student loan process without feeling lost.

If you’re just starting out, the world of student loans can feel like two giant doors: one marked “Federal” and the other “Private.” I remember sitting at my desk years ago, staring at those options on a financial aid website, and honestly? I had no clue which one to pick. Both promised money for school, but the fine print was a whole different story.

Federal student loans come from the U.S. Department of Education, while private loans are issued by banks, credit unions, and online lenders. That sounds simple, but the ripple effects are huge. Federal loans usually don’t need a credit check, have fixed interest rates, and come with government-backed protections. Private loans, on the other hand, are tied to your creditworthiness (or your cosigner’s) and can have variable interest rates that swing with the market.

When I was first comparing them, it hit me how different the repayment terms were. Federal loans offered flexible options like income-driven repayment, while private loans often locked you into stricter terms. Basically, federal loans are like having a safety net under your tightrope, while private loans feel more like walking without one.

Here’s the deal: federal loans are designed to help students, not to make a profit. That’s why they’re almost always the first recommendation. They come with perks like subsidized interest (the government pays the interest while you’re in school if you qualify), loan forgiveness programs, and deferment or forbearance options if you hit tough financial times.

I learned this the hard way. A friend of mine went straight to a private lender because the application felt “easier.” She didn’t realize that she was locking herself into a loan with a 12% interest rate, ouch. Meanwhile, my federal loan sat at around 4%, and I had way more options after graduation. That’s why financial aid counselors almost always say: exhaust federal loans before even looking at private ones.

Federal loans usually carry lower interest rates and fixed terms, meaning your rate doesn’t jump unexpectedly. Repayment is flexible, too, you can switch to an income-driven plan if your paycheck is small or extend your term if needed. Borrower protections are another big deal. For example, if you become disabled or if your school closes while you’re enrolled, federal loans have forgiveness options built in.

Private loans? Not so much. Rates can range wildly, and repayment terms aren’t usually designed with struggling students in mind. Sure, some lenders offer temporary forbearance, but it’s nothing compared to the safety nets federal loans provide.

That said, private loans aren’t all bad. They can make sense if you’ve maxed out your federal borrowing limit or if you’re pursuing a degree with high earning potential, like medicine or law. Some private lenders even offer competitive fixed rates if you (or your cosigner) have excellent credit.

I’ve seen classmates use private loans as a bridge, covering the gap between what federal aid provided and the actual cost of tuition. It worked for them because they had strong repayment plans lined up. But for most students, I’d say private loans should be a last resort.

One of the first things I wondered when I was filling out financial aid forms was, “Am I even eligible for this stuff?” Turns out, the requirements aren’t as complicated as they seem, but missing just one detail can trip you up. Student loan eligibility depends on a mix of legal, academic, and financial factors. Let’s break it down so you know where you stand.

Most federal student loans are available only to U.S. citizens or eligible noncitizens (like permanent residents). That was a wake-up call for one of my international classmates, he couldn’t get federal aid and had to rely on private lenders. If you fall into that category, you might need a U.S. cosigner to get approved for a private loan.

For citizens, the process is much more straightforward. All you need is a valid Social Security number and proof of residency. The FAFSA system verifies this automatically, but it’s worth double-checking your details because even a typo can delay your application.

Federal student loans usually require you to be enrolled at least half-time in a qualifying program. I remember a semester when I dropped a class and slipped just below that threshold, suddenly my loan disbursement was on hold. It was stressful!

Being full-time makes things smoother, but if you’re part-time, don’t worry, you can still qualify as long as you meet the minimum credit hours. Just check your school’s definition of “half-time,” because it varies. Private lenders are similar, but they may be stricter about enrollment status.

This is a biggie. Federal student loans (except PLUS loans) don’t require a credit check. That’s a lifesaver for students with no credit history. When I applied for my first federal loan, I had zero credit cards and no credit score, but I was still approved.

Private loans, however, are a different beast. Lenders will pull your credit report, and if you don’t have much credit history, they’ll probably ask for a cosigner. Interest rates are directly tied to creditworthiness, so the stronger your score, or your cosigner’s, the better the terms.

Financial need plays a role in federal aid, especially with subsidized loans and grants. FAFSA calculates your Expected Family Contribution (EFC), which basically estimates how much your family can afford to pay. I’ll be honest: when I saw my number, I laughed. It felt way higher than what we could actually pay. But that’s how the system works.

Private lenders usually don’t care about financial need, they just want to know if you can repay the loan. That’s why income, credit history, and cosigner strength matter more in their world.

At the end of the day, qualifying for student loans isn’t as scary as it seems. As long as you’re enrolled, meet the basic residency requirements, and fill out FAFSA on time, you’re in the game. And if you need private loans, having a cosigner with solid credit makes a huge difference.

When I first heard the word FAFSA, I thought it was some scary government test I had to pass. Truth is, it’s just paperwork, but really important paperwork. The Free Application for Federal Student Aid is the golden key to unlocking federal student loans, grants, and even work-study programs. Mess it up, and you risk losing money you’re entitled to. Do it right, and you’ll breathe easier knowing your education has funding behind it.

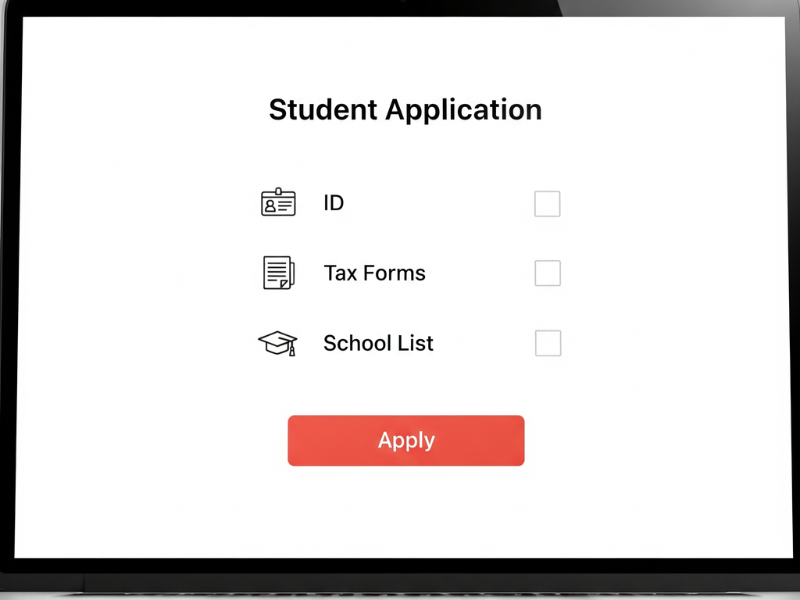

The FAFSA process might look intimidating, but it’s straightforward once you know the steps:

The first time I filled it out, I kept thinking, “What if I mess this up?” Turns out, the system actually flags errors before you submit, which saved me from sending it off with missing info.

To start your application, here’s what you’ll need:

It feels like a lot, but having these in a folder before you start makes the process way smoother.

Oh boy, I made one of these mistakes myself. I once entered the wrong school code and almost sent my info to a college I wasn’t even applying to. Here are some common errors you’ll want to avoid:

Double-check everything before hitting submit. Seriously, it’s worth the extra 10 minutes.

This part feels like math class. FAFSA takes your financial info and calculates your Expected Family Contribution (EFC). That number helps determine how much federal aid you qualify for, including grants, subsidized loans, and work-study. Schools then use it to build your financial aid offer.

It might feel unfair at times; your EFC may look way higher than what your family can actually cover. Mine did, and it caused more than a few dinner table arguments. But remember, loans and grants aren’t decided solely on that number, schools’ factor in their own costs too.

At the end of the day, filling out the FAFSA is step one if you’re serious about funding college. It’s free, it’s required for federal loans, and it can even help with some private scholarships. Skip it, and you’re leaving money on the table.

After tackling FAFSA, I thought I was done. But when the financial aid letter came in, it didn’t cover the full cost of tuition plus housing. That’s when I had to look at private student loans. They can feel like stepping into a different world, less forgiving than federal loans, but sometimes necessary to bridge the gap.

When I first searched “private student loans,” my screen exploded with ads. Everyone claimed to have the “best rates.” The trick is filtering out the noise. Start with big-name banks, credit unions, or online lenders that have a history with student loans. Sites like NerdWallet or Bankrate helped me compare lenders without feeling like I was walking blind into a sales pitch.

One rule I followed: if a lender seemed shady, promised instant approval, or avoided explaining terms, I ran the other way. With student loans, transparency is everything.

Here’s where it gets personal. Unlike federal loans, private loans dig into your credit. When I applied, I didn’t have much credit history, so I needed my dad to cosign. The lender looked at his income, credit score, and employment history before giving the green light.

Typically, lenders will ask for:

If you don’t have a cosigner, getting approved can be tough, unless you already have strong credit.

I’ll be honest, this part made my head spin. One lender offered me a variable interest rate that looked low at first, but could skyrocket later. Another offered a fixed rate that was higher upfront but predictable. I ended up choosing fixed, because the last thing I wanted was surprise jumps in payments after graduation.

Repayment terms also vary, some let you pay interest while in school, some defer everything until after you graduate. I calculated what each option would mean monthly, and that helped me avoid biting off more than I could chew.

If your credit is thin (like mine was), don’t panic. Here are a few things that helped me:

At the end of the day, private loans should be treated like a backup plan, not your first line of defense. They can help fill the gap, but only if you approach them with eyes wide open and a clear repayment strategy.

If I could go back in time and give my younger self one piece of advice about student loans, it would be this: just because you’re offered a certain amount doesn’t mean you should take it. I learned that lesson the hard way, staring at a balance statement after graduation that made my stomach drop. Borrowing smart isn’t about saying yes to all the money; it’s about saying yes to just enough.

The first financial aid letter I got felt like a golden ticket, it listed more loan money than I actually needed for tuition. I’ll admit it, I was tempted to take the whole thing and use the extra for off-campus fun. Big mistake. Every dollar you borrow accrues interest, and those “extras” quickly balloon into thousands over time.

What worked better for me later on was calculating tuition, fees, and basic living expenses, then borrowing for only that. I covered the rest with part-time work and budgeting. It wasn’t glamorous, but future-me was a lot happier.

One night, halfway through college, I stumbled across a loan repayment calculator online. I punched in my balance, interest rate, and repayment term. The number that popped up, my future monthly payment, was a serious wake-up call.

Do this before borrowing: figure out what your payment will look like after graduation. If it’s higher than a reasonable chunk of your expected salary, scale back your borrowing or look for other funding. Trust me, you don’t want your first paycheck swallowed by debt.

This is the part I used to roll my eyes at in high school, everyone said “apply for scholarships.” I thought it was a waste of time. Turns out, even small scholarships stack up and directly lower how much you need to borrow.

During my junior year, I also grabbed a part-time campus job. It covered groceries and books, which meant I didn’t need to add those costs to my loan. Between that and a few grants, I managed to shave off thousands from what I would have owed.

This is one of those details that sounds boring but is huge in the long run. Subsidized loans don’t rack up interest while you’re in school, the government pays it for you. Unsubsidized loans, on the other hand, start building interest the second they’re disbursed.

When I found that out, I made it a rule to accept subsidized loans first and unsubsidized only if I had no other option. It doesn’t sound like much, but cutting out years of accrued interest made a real difference in my balance later.

Borrowing smart comes down to discipline. It’s easy to think of loan money as free cash when it’s sitting in your account, but it’s not. Every choice you make while borrowing shapes your financial future. The less you take, the freer you’ll feel when those repayment letters hit your inbox.

Graduating is a big milestone, but it also marks the start of loan repayment. Understanding your repayment options ahead of time helps you transition smoothly and avoid falling behind. Whether you have federal or private student loans, here’s what to expect and how to manage repayment responsibly.

Most federal student loans come with a six-month grace period after you leave school, during which you don’t have to make payments. This time is meant to help you find a job and get settled. Private lenders may or may not offer grace periods, so it’s important to check your loan agreement. Use this window to create a repayment plan, build a budget, and set up automatic payments so you’re ready once repayment kicks in.

The standard repayment plan for federal loans spreads payments evenly over 10 years. While this option gets you out of debt the fastest and with the least amount of interest paid, the monthly payments can be higher compared to other plans. If you can afford it, this plan is often the most cost-effective.

If your monthly payment under the standard plan feels unmanageable, income-driven repayment plans may be the solution. These tie your payment amount to your income and family size, making them more affordable when you’re just starting out. After 20–25 years of qualifying payments, any remaining balance may be forgiven. While this option reduces monthly stress, keep in mind that you’ll pay more interest in the long run.

For borrowers juggling multiple loans, consolidation allows you to combine federal loans into a single payment. Refinancing, offered through private lenders, can sometimes lower your interest rate, but be cautious. Refinancing federal loans with a private lender means you’ll lose federal protections like income-driven plans and forgiveness options.

If you work in qualifying public service jobs, you may be eligible for loan forgiveness after making 120 qualifying monthly payments under an income-driven repayment plan. This program can save you tens of thousands of dollars if you meet the requirements, but it demands strict documentation and compliance.

Repaying student loans is a long-term commitment, but it doesn’t have to be overwhelming. By understanding your repayment options early and choosing the right plan for your situation, you can take control of your debt and focus on building your future.

Paying for college can feel overwhelming, but understanding how to get student loans makes the process much more manageable. From comparing federal and private options to filling out applications, preparing documentation, and planning for repayment, every step you take now is an investment in your future.

The key is to be proactive, research your options, borrow only what you need, and think ahead about how repayment will fit into your long-term financial goals. With the right approach, student loans can be a helpful tool to bridge the gap between the cost of education and the resources you already have.

Want to dive deeper into financial topics? Check out our other guides:

Not always. Federal student loans don’t require a credit check (except PLUS loans), which makes them accessible to most students. Private loans, however, do look at your credit score and may require a co-signer if you don’t have established credit.

Yes, but options are limited. Most federal loans are for U.S. citizens and eligible noncitizens. International students usually need to apply for private loans and often must have a U.S. co-signer.

The earlier, the better. Federal loans start with the FAFSA, which opens each year on October 1 (for the following school year). Applying early ensures you don’t miss out on aid with limited funding.

Subsidized federal loans don’t accrue interest while you’re in school at least half-time. Unsubsidized loans start collecting interest immediately, even during your studies.

For federal loans, borrowing limits depend on whether you’re a dependent or independent student and your year in school. Private lenders set their own limits, usually based on your credit and school costs.

Yes, and there are no prepayment penalties on federal or most private loans. Paying extra reduces your principal balance faster and helps you save on interest.

Some are. Programs like Public Service Loan Forgiveness (PSLF) or income-driven repayment forgiveness can eliminate remaining balances if you qualify and meet the requirements.