Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

“Did you know the average federal student loan borrower owes over $37,000 in the U.S.? That’s more than many people make in a year!” If that number makes your stomach drop, you’re not alone. Millions of graduates and even parents are navigating repayment, often confused about where to begin.

The good news? Paying off your student loans doesn’t have to feel overwhelming. With the right plan, you can lower your monthly payments, avoid costly mistakes, and even speed up your path to financial freedom. In this guide, I’ll walk you through practical repayment strategies, loan forgiveness options, and insider tips I’ve learned along the way.

When I first started paying back my loans, I’ll be honest, I had no clue there was even a difference between federal and private loans. I just knew I owed money, and it needed to be paid. That lack of understanding cost me time and probably a good chunk of money too. So before diving into repayment plans or hacks, the smartest move is figuring out what type of loans you have. It shapes every single option you get later.

Federal loans are backed by the government, and that comes with some pretty big advantages. They usually have lower interest rates, built-in protections like deferment or forbearance, and access to forgiveness programs. I learned this the hard way because my federal loans were way more flexible when I lost my job for a few months. Private loans, on the other hand, come from banks or credit unions. They can sometimes offer competitive rates if you have excellent credit, but there’s little wiggle room when life happens. No forgiveness, limited repayment plans it’s strict.

One mistake I made early on was trying to refinance everything into one private loan. It lowered my monthly payment at first, but I lost access to forgiveness programs I might’ve qualified for. Looking back, I wish I’d kept my federal loans separate.

The type of loan you hold decides which repayment doors are even open to you. Federal loans unlock income-driven repayment (IDR) plans, forgiveness programs like PSLF, and even interest subsidies in certain cases. Private loans? Not so much. The options usually boil down to negotiating with your lender or refinancing if your credit score is solid.

Think of it like this: federal loans give you a toolkit full of wrenches, screwdrivers, and pliers. Private loans hand you a hammer and say, “Good luck.” Knowing which one you’ve got means you won’t waste time trying to apply for something you don’t qualify for.

The easiest way to start is by logging into your Federal Student Aid account (studentaid.gov) to see all your federal loans in one place. I remember being shocked the first time I logged in,I had way more smaller loans than I realized, and each had slightly different interest rates. For private loans, you’ll need to check your credit report or dig up the original paperwork to see who your lender is.

One tip that saved me a ton of headaches: write down your loan servicers, interest rates, and balances in one spreadsheet. Every time I made an extra payment, I updated it. It gave me a clear view of where my money was going and helped me target the high-interest loans first. Without that spreadsheet, I would’ve been throwing money blindly.

I’ll never forget the first time I looked at all the repayment plan options, it felt like alphabet soup. Standard, IDR, graduated, extended… I honestly thought I needed a financial advisor just to pick one. But once I slowed down and compared them side by side, the picture got clearer. The key is choosing a plan that actually fits your income and life stage, not just the one with the smallest monthly payment.

This is the default plan most borrowers are placed into, and it spreads your balance over 10 years. The good part? You’ll pay less interest overall and get debt-free faster. The bad part? The monthly payments can be steep. I tried sticking with this right out of college, but my entry-level salary made it brutal. If your income is steady and you can afford it, though, this plan saves you thousands in the long run.

When I couldn’t keep up with the standard plan, I switched to an income-driven repayment plan, and honestly, it was a lifesaver. These plans cap your payment based on your income and family size, which made things much more manageable. There are a few flavors, PAYE, REPAYE, IBR, and while the acronyms are confusing, the idea is simple: your payment adjusts with your income. The downside? You’ll likely pay more interest over time, but some of the balance can be forgiven after 20–25 years. I remember the relief of making a $150 payment instead of $400 one month, it gave me breathing room.

If you expect your income to grow, the graduated repayment plan starts with lower payments that increase every two years. I actually tried this when I got my first promotion, and while it helped at the start, the payments eventually ballooned. Extended repayment, on the other hand, stretches your loan over 25 years. It lowers the monthly hit, but you’ll pay a lot more in interest. It’s kind of like trading short-term relief for long-term cost.

One lesson I learned too late: you don’t have to stick with one plan forever. I used to think switching would hurt my credit or mess things up, but in reality, it’s pretty straightforward. If you land a higher-paying job, it might make sense to jump back to the standard plan to save on interest. On the flip side, if money gets tight, switching to IDR or extended repayment could be the buffer you need to stay out of default.

Repayment isn’t a one-size-fits-all deal. The best plan is the one that matches where you’re at financially right now, not where you think you should be.

Once I finally wrapped my head around repayment plans, I got obsessed with finding ways to pay my loans off faster. The thought of carrying student debt for decades made me feel trapped, so I started experimenting with little tricks to speed things up. Some of them worked, some didn’t, but every extra dollar chipped away at the balance.

The first mistake I made was sending extra money without specifying it should go toward the principal. My servicer just applied it to next month’s payment, which didn’t help me get out of debt quicker. Once I learned to call them and request that extra payments hit the principal balance directly, it made a huge difference. Knocking down the principal lowers how much interest racks up, which is the real secret sauce to paying loans off sooner.

Another trick that worked for me was switching to bi-weekly payments instead of monthly. It felt less painful to pay smaller amounts every two weeks, and by the end of the year, I had essentially made one extra full payment without even noticing. It sounds small, but over time, that strategy shaved months off my payoff schedule.

I used to treat my tax refund like “fun money,” but once I got serious, I threw the whole thing at my loans. Same with work bonuses or birthday cash from family. It wasn’t glamorous, I’d have loved to buy a new phone instead, but watching my balance drop by a few hundred or even a thousand dollars in one shot gave me momentum. I’ll admit, it hurt at first, but the long-term payoff was worth it.

At one point, I refinanced some of my private loans to snag a lower interest rate. It worked out for me because I had a decent credit score by then, and it cut down the total interest I’d pay. But I’d never refinance federal loans into private ones again, I learned that lesson the hard way when I lost access to forgiveness programs. Refinancing can be powerful, but it’s not for everyone, and timing matters.

What I found is this: there’s no single “magic” trick to paying loans off fast. It’s a mix of smart strategies, discipline, and using every opportunity, whether that’s extra cash, bi-weekly payments, or refinancing, to get ahead bit by bit.

When I first heard about loan forgiveness, I thought it sounded too good to be true, like some loophole nobody actually qualified for. But once I dug deeper, I realized there are real programs out there, though they come with plenty of fine print. If you qualify and stick with the rules, forgiveness can wipe out a big chunk of your student debt.

I actually considered PSLF back when I worked at a nonprofit. The deal is simple in theory: make 120 qualifying payments (that’s about 10 years), work full-time for a government or nonprofit employer, and the rest of your federal loan balance gets forgiven. The catch? You have to be on an income-driven repayment plan, and your employer must qualify. I know someone who had paperwork rejected because they didn’t submit employer certification forms each year. Lesson learned, documentation is everything with PSLF.

Teachers have a different program that can forgive up to $17,500 of federal loans if you teach in a low-income school for five consecutive years. My cousin qualified for this, and while it didn’t clear her balance completely, it made a big dent. The hard part was sticking with the same school for the required time, but for her, it was worth it.

If you happen to have Perkins loans (not everyone does, since the program ended a few years back), there are special cancellation benefits for certain jobs like teachers, firefighters, and even librarians. I never had Perkins loans myself, but I’ve met borrowers who had their entire balance wiped clean through steady service.

Not all forgiveness programs are federal. Some states offer repayment help if you work in high-need areas like healthcare or education. A friend of mine in the medical field got part of her loans covered just by practicing in a rural area for a few years. On top of that, some employers now offer student loan repayment as a perk. It’s not as common as a 401(k), but it’s growing. If you’re job-hunting, it’s worth asking.

Loan forgiveness programs aren’t quick fixes, they take time, paperwork, and a lot of patience. But if you qualify, they can save you tens of thousands of dollars. For me, just knowing these programs existed gave me hope on the days when my debt felt crushing.

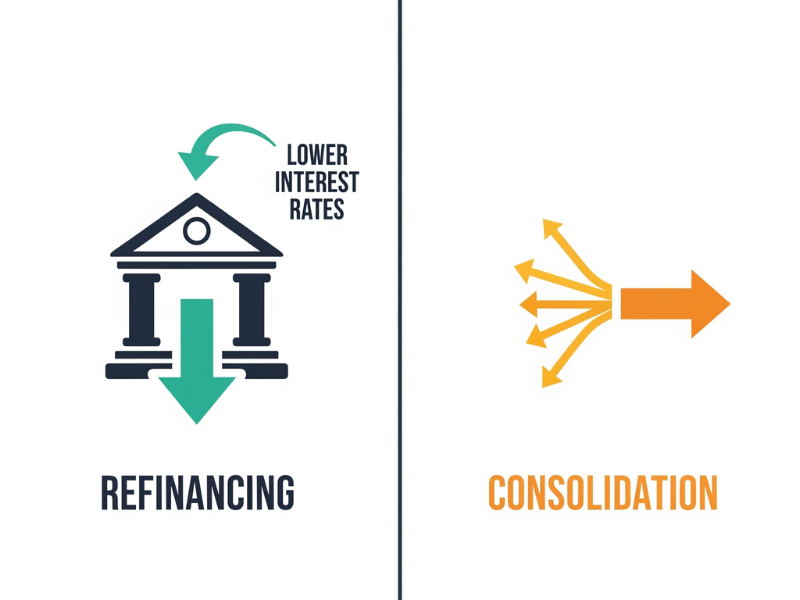

I used to think refinancing and consolidation were just two words for the same thing. Turns out, they’re completely different, and picking the wrong one can lock you into a bad deal. Once I learned the differences, I realized how important it was to weigh the pros and cons before making a move.

Refinancing basically means taking out a brand-new loan with a private lender to pay off your old loans. The big win is usually a lower interest rate, which can save you thousands over the life of the loan. I refinanced one of my private loans after my credit score improved and shaved my interest rate down by 2%. That felt like a huge win. The catch? Once you refinance a federal loan into a private one, you lose all those federal protections, IDR, deferment, and forgiveness programs. For me, I only refinanced private loans, so I didn’t lose the safety net.

This is the mistake I almost made. Refinancing federal loans can look appealing because of the lower rates, but it’s like trading a parachute for a cheaper ticket. Sure, your payment might drop, but you give up access to income-driven repayment, forgiveness, and flexible deferment options. I know someone who refinanced federal loans right before they qualified for PSLF, and they lost out on forgiveness. That’s a mistake I’ll never forget.

Loan consolidation is a federal program that combines multiple federal loans into one new loan. The benefit? One single payment instead of juggling five or six different servicers. You can also lock in a fixed interest rate (it’s the weighted average of your loans, rounded up a little). When I consolidated, it made my life so much easier because I didn’t miss payments anymore. It didn’t save me money on interest, but the simplicity was worth it.

The biggest mistake I made was consolidating loans just to reset my repayment clock. It pushed forgiveness further down the road because consolidation restarts the count for qualifying payments. Another mistake I see often is refinancing too early, before building good credit or a stable income. That can trap you with worse terms than you had before. My advice? Only consolidate federal loans for simplicity, and only refinance if you’re 100% sure you won’t need federal protections later.

In short, consolidation is about simplifying federal loans, while refinancing is about lowering interest rates with a private lender. Mixing the two up could cost you, so make sure you know which tool you’re actually using.

For me, the turning point with student loans wasn’t just switching repayment plans, it was changing my everyday habits. Once I started treating loan repayment like a line item in my budget instead of an afterthought, progress actually showed up. It wasn’t fun cutting back, but every adjustment made those payments feel doable instead of impossible.

I started by writing down every single expense, even the silly ones like late-night takeout. Seeing it all on paper (or in Excel, in my case) was a wake-up call. I created a zero-based budget, where every dollar had a job, and I made “extra loan payment” its own category. That small change meant I actually planned for debt repayment instead of hoping leftover money would cover it, which, let’s be honest, it never did.

At first, I thought budgeting meant living on rice and beans. But I found out I didn’t need to strip my life bare; I just needed to cut the leaks. Canceling subscriptions, I barely used, cooking at home more often, and negotiating my phone bill added up faster than I expected. One month, I saved nearly $200 just by cutting those three things. That’s an entire extra student loan payment right there. I still kept small joys like coffee runs, because cutting everything just made me quit the budget altogether.

Honestly, budgeting alone wasn’t enough. I picked up freelance gigs and a weekend job tutoring, and every cent of that side hustle money went straight to loans. It wasn’t glamorous, some weekends were exhausting, but knowing I was shaving months off my debt timeline made it worth it. Even selling stuff around the house on eBay brought in a couple hundred dollars. That’s when I realized, making extra money sometimes works better than cutting expenses.

The hardest part of long-term repayment is staying motivated when progress feels slow. What helped me was creating a visual tracker, a simple chart where I colored in boxes each time I paid $500. Watching that progress build kept me going. Some people use apps, others use spreadsheets, but for me, that paper chart stuck on the fridge reminded me why I was saying no to impulse buys.

What I learned is this: budgeting and lifestyle changes don’t have to feel like punishment. They’re tools to take control back. Once I reframed it that way, repayment felt less like a burden and more like a challenge I was slowly winning.

I remember the month my rent jumped, and my paycheck didn’t. I missed a payment and felt my chest tighten. If you’re there now, take a breath, there are concrete steps you can take to protect your credit and give yourself time to get back on your feet.

If your hardship is temporary, job loss, medical issue, or short-term financial shock, ask your loan servicer about deferment or forbearance right away. Deferment can pause payments, and, for certain federal loans, interest may not accrue; forbearance pauses payments, but interest accrues on all loans, which can make your balance grow. Contact your servicer, explain the situation, and be ready to provide documentation like an unemployment letter or medical paperwork to support the request.

Don’t treat these options as permanent fixes. I used forbearance once and later regretted not understanding that interest kept piling on. That extra interest capitalized and increased my balance. Use deferment or forbearance to buy time, then pair it with a plan to either lower payments permanently or actively reduce principal when you can. Federal Student Aid

Missing payments can quickly snowball. For federal loans, default generally happens after about 270 days of missed payments and brings serious consequences like wage garnishment, tax refund or federal benefit offsets, and referral to collection agencies. With collections resuming in 2025, these collection tools are back in force for borrowers who are already in default, so acting early matters. If your loan has already gone into default, there are recovery routes, but they take work, loan rehabilitation or consolidation are common options.

Call or message your servicer as soon as payments feel risky. Have these on hand: your account number, recent pay stubs or unemployment documents, and a short-written summary of your situation. Ask specifically about income-driven repayment plans, deferment, forbearance, or hardship options and request next steps in writing or by secure message. I learned that getting the agreement in writing saved me headaches later when I needed proof of an approved forbearance.

If your loan is in default, contact the Department of Education’s Default Resolution Group or your servicer to learn about rehabilitation or consolidation. Rehabilitation usually requires making a series of on-time payments under an agreement, and consolidation can roll defaulted loans into a new federal loan that restores eligibility for some programs. Both options have pros and cons, so get clear instructions from the servicer before you act.

You don’t have to figure this out alone. Nonprofit organizations like the National Foundation for Credit Counseling offer free or low-cost counseling that can help you map out a budget and a realistic repayment plan. I called a counselor once and they helped me prioritize payments and spot programs I didn’t know existed. If you go this route, choose a certified nonprofit counselor and avoid services that demand large upfront fees.

Takeaway: act fast, get help, and document everything. Contact your servicer, explore deferment or forbearance as short-term relief, ask about income-driven plans for longer-term help, and reach out to a nonprofit counselor if you need a guided plan. Doing those things early will protect your options and keep you from paying far more in the long run.

Repaying student loans may feel daunting at first, but it doesn’t have to define your financial future. With the right strategy, whether that’s choosing the best repayment plan, refinancing for lower interest, or building a budget that keeps you on track, you can steadily make progress. Every payment you make is a step toward financial freedom.

Stay flexible, revisit your plan as your income and life circumstances change, and don’t be afraid to explore options like forgiveness programs or side hustles to accelerate the process. The key is consistency. Over time, the effort you put in now will reward you with the peace of being debt-free and the freedom to focus on the next chapter of your financial journey.

Want to dive deeper into financial topics? Check out our other guides:

Start by identifying your loan type—federal or private—and your loan servicer. Then, choose a repayment plan that fits your income and budget. Setting up autopay can also help avoid missed payments and sometimes lower your interest rate.

Federal loans are backed by the government and offer benefits like income-driven repayment plans, deferment, and forgiveness programs. Private loans come from banks or credit unions, usually with less flexibility and fewer repayment options.

Yes! You can make extra payments toward your principal, use windfalls like tax refunds or bonuses, adopt a bi-weekly payment schedule, or consider refinancing private loans to lower interest rates. Even small additional payments can make a difference over time.

Loan forgiveness programs reduce or eliminate your remaining federal student loan balance after meeting specific criteria, such as working in public service, teaching, or certain healthcare roles. Eligibility depends on the program, the type of loan, and your repayment plan.

Refinancing can lower interest rates but may remove federal protections, so it’s best for private loans. Consolidation combines multiple federal loans into one, simplifying payments but usually not saving money on interest. Choosing the right option depends on your loan types and goals.

If your payments are unmanageable, contact your loan servicer immediately. Options include income-driven repayment plans, deferment, forbearance, or seeking nonprofit credit counseling. Avoid default at all costs, as it can severely damage your credit.

Yes. Paying extra toward the principal, refinancing eligible loans, and enrolling in autopay (which often gives a small interest reduction) are effective strategies to reduce total interest paid over time.

Absolutely. Freelancing, tutoring, ridesharing, or selling unused items can generate extra income specifically for loan payments. Even modest earnings can significantly reduce your repayment timeline if applied consistently.